Google's Search Engine Monetization

More than 20 years after its founding, Google’s advertising business remains the largest source of Alphabet’s income. (Alphabet is Google’s parent company.) While 2019 results have not yet been disclosed, for 2019 advertising is expected to contribute 83% of Alphabet’s total expected revenue of $171 billion1.

As a public company, Alphabet is expected to show consistent growth quarter after quarter. Alphabet has been growing over 20% each year for the past 10 years. As 80% or more of Alphabet’s income comes from advertising, it’s no surprise that Google changes to its search engine and its result page through the years aim to grow this revenue stream even further.

Maximizing advertising income

Thanks to its accurate search results, Google is the most visited website on the internet and the internet’s front door. According to Sparktoro, as of 2019 Google has a 94% market share of total searches on the Internet.

Top space in Google search result’s page is the most valuable, because people tend to check just the first few result on the page. For years now, the top spots of the search engine results page have been reserved for Google ads.

Google advertising system is clevery engineered to maximize advertising revenue. “Google Ads runs an auction every single time it has an ad space available —on a search result, or on a blog, news site, or some other page. Each auction decides which ads will show at that moment in that space. Your bid puts you in the auction.2” This advertising model drives the cost for advertisers up, effectively transfering value from the businesses/advertisers to Google.

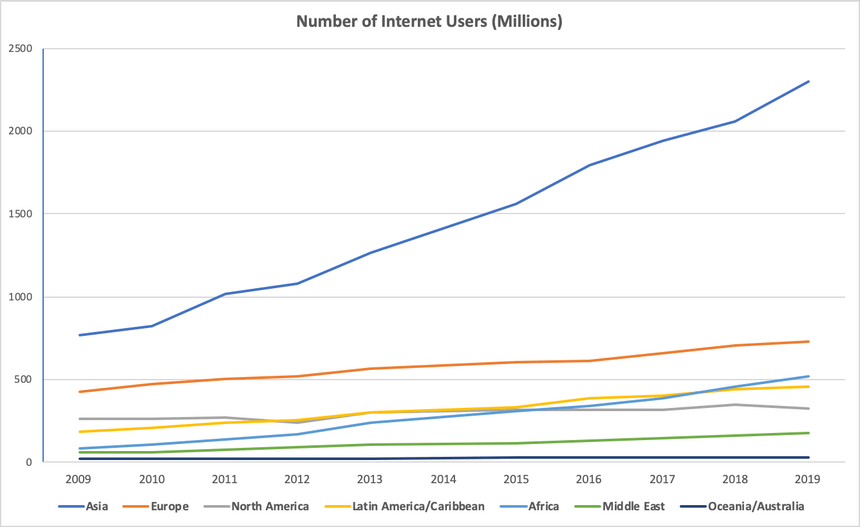

Internet adoption is slowing down

Internet adoption is slowing down in Google’s most lucrative markets like North America and Europe. Asia is still growing, but some years ago Google closed operations on China, Asia’s biggest market. To continue growing its advertising business, Google needs both to charge more for each click, and increase the volume of paid clicks on their results page.

Internet usage 2009-2019. Source: Statista

Consider this quote from Google’s co-founder Larry Page, from the company’s S-1 filling in 2004:

(…) Most portals show their own content above content elsewhere on the web. We feel that’s a conflict of interest, analogous to taking money for search results. Their search engine doesn’t necessarily provide the best results; it provides the portal’s results. Google conscientiously tries to stay away from that. We want to get you out of Google and to the right place as fast as possible. It’s a very different model.

We built a business on the opposite message. We want you to come to Google and quickly find what you want. Then we’re happy to send you to the other sites. In fact, that’s the point. [In contrast] The portal strategy tries to own all of the information.”

This is not true anymore. Google has been changing their search engine from a place where you find links to the answers you are searching for and leave, to a place where you find the answers you are searching for and stay.

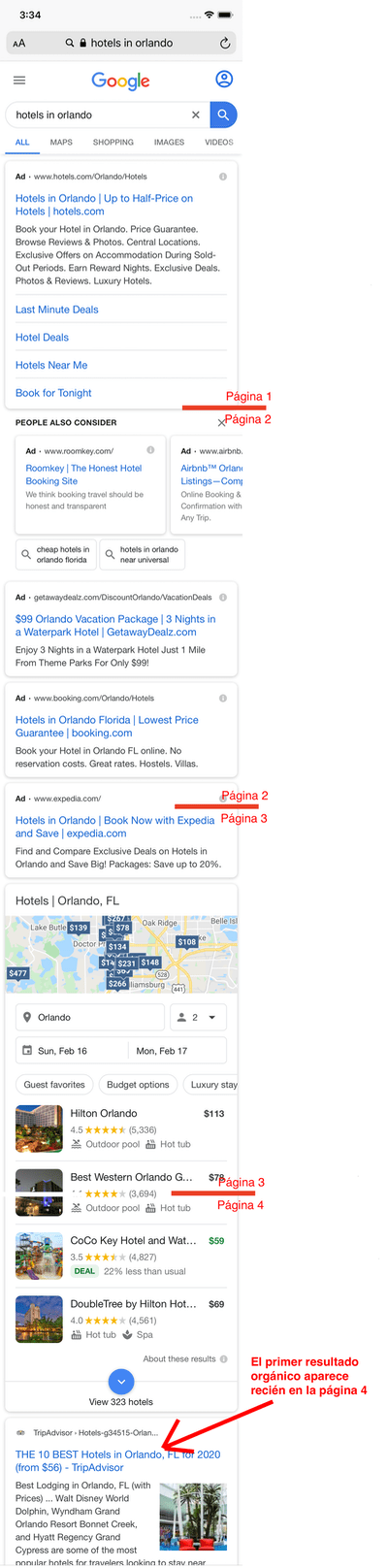

Ads own the best places on the results page

For years now, ads have been given the top spot on the search results page, displacing organic search results. At first, ads were clearly differentiated from organic search results, but recent changes in styling make differentiating organic search results from ads harder.

Depending on the search category, after the ads Google places an information block, with information automatically compiled by Google by scrapping the most relevant pages. In other categories like flight search or hotel booking, a special module is shown where the user can directly book a flight or an hotel with one of Google’s partners.

Google partners are companies that most times pay Google to appear in such a spot, or where Google earns a fee after a sucessful booking, which implies another advertising-related income stream for Google.

Organic results appear after these blocks and modules. On mobile, this may be on page 4 onwards. Good luck trying to drive traffic to your site by using SEO (Search Engine Optimization) to rank high on the search engine’s organic results. Most users searching on Google will never see those results. A recent example of this is Expedia, which reported lower-than-expected profit margins in 2019 due to increased Google Ads spenditure thanks to an important reduction in organic search traffic to their site.

For businesses, the opportunity is to provide a better experience than Google’s for specific sectors or needs. This doesn’t mean it’s easy, only that it may be one of the few ways to compete with Google. One of the reasons customers head directly to Amazon over Google and even over product brands’ own webpages is the superior shopping experience.

From Search Engine to Answer Engine

In 2019, 68% of Google searches were done on smartphones. This is one of the reasons why Google pays Apple several billion dollares each year to be the default search engine in iOS3 and of Android being heavily subsidized so it’s essentially free, but in Google’s tight control.

When using mobile devices for searching the web, it’s more convenient for users to have the answers to their queries in the same search results page, because otherwise they have to click and load additional pages.

SparkToro’s Rand Fiskin points out that Google is “moving from search engine to answer to engine and now to a direct competitor for an enormous number of websites and businesses. (…) The largest source of traffic on the web — free and paid — is becoming a walled garden, intent on not only keeping people on its own properties, but competing directly with those that helped it become a dominant, monopoly power.”

Is Google succeeding at keeping people in their website? According to Sparktoro, it is. In 2019 more than 50% of Google searches where zero-click searches, which means Google showed enough information on the results page itself so that the user didn’t need to click on any further link. 4% of the time, the user clicked a link to another Google property or partner.

Long-term thinking

From the user’s perspective, the changes Google is introducing are not bad per se. Why wouldn’t someone like Google summarizing the information for her, saving time and effort? Most people will see this as a benefit, and don’t care much what’s going on behind the curtains. As long as results are unbiased, aggregating the relevant information on the results page offers convenience for the user.

This strategy may benefit Google advertisement revenues for some years. However, in the long run it can lead to a loss of value on Google as a search engine. Advertisers bidding for ads don’t aim at providing accurarte search result, but converting leads into clients. People searching on Google won’t see the best answers, but the answerss of those companies that paid more. (Forget about someone doing a great review of an hotel in her personal blog.)

When Google was founded in 1998, portals like Yahoo! and Altavista owned most of the Internet’s traffic, and offered paid results. People were not happy and Google seized the opportunity. As Seth Godin points out, sooner or later, the shark gets jumped.

The other question is: is Alphabet/Google remaining an advertising company in the long run, or will it be able to grow another business that can rival the $170 billion generated anually by Google Advertising?

Este artículo está también disponible en español con el título Google y la explotación de su motor de búsqueda

Featured image photo credits: Rajeshwar Bachu on Unsplash.

- cfr Alphabet’s Revenues: How Does Alphabet Make Money?. Google other businesses make up 16.3% ($27.9 billion) for 2019. Other non-Google businesses, which are emerging areas in various stages of development, are reported collectively by Alphabet as Other bets and make up 0.4% of Alphabet’s revenue. ↩

- cfr Google Ads on Google’s Support page. ↩

- Several articles estimate that Google paid around $9 Billion in 2018, but the only hard data I found says it paid $1B, which is nonetheless a lot of money. (cfr Google reportedly paying Apple $9 billion to remain default search engine in Safari on iOS and Google to Pay Apple $12 Billion to Remain Safari’s Default Search Engine in 2019: Report.) ↩